Canadian-Money-Advisor.ca BLOG

What is Capital One Canada Bank Credit Cards?

Capital One Canada is an acknowledged leader in providing competitive credit card interest rates, admirable services and exclusive rewards to Canadian consumers. Capital One provides an individualized approach that reduces problems in finding the right card for each card holder. The goal of Capital One is to meet the financial needs and concerns of its customers.

This article discusses the following:

- Capital One Credit Card Promotions

- Rewards Programs

-->

What are Capital One Credit Card Promotions?

If you are not yet very familiar with Capital One credit cards, you must know that Capital One is a diversified financial services company offering an assortment of credit cards, savings and loan products in Canada. Perhaps, you have seen the Capital One credit card promotions for television recently that shows all the benefits of this great card. The Capital one secured charge cards offers very special benefits for a group of people that would not receive a normal regular charge card. The people who want such a credit card may not be eligible for most other types of credit cards. Capital One offers the widest range of bank cards for consumers of varied credit levels. Credit cards have become an important part of the modern world. Even to rent a car, one needs to have a charge card. Compare interest rates, annual fees, rewards and other features to find a bank card that is right for you.

The time frame for these types of cards is six to 12 months from the date of purchase. This is a better choice - zero percent credit cards. This means that you need to pay back the exact sum for the product without incurring any extra interests.

-->

What are Rewards Programs?

Capital One bank cards offer a number of rewards programs, where earned points can be redeemed for travel, cash, merchandise, charitable donations or gift cards. Particular packages may only be available to customers with good payment histories or with credit ratings Point scores above a particular level. Find out more about these options and what you can qualify for. Capital One bank cards offer a number of rewards programs, where earned points can be redeemed for travel, cash, merchandise, charitable donations or gift cards. Particular packages may possibly be available to customers with good payment histories or with point scores above a particular level. The relation to a reward program can also vary, depending on the customer's credit profile.

What are the Different Categories of the Rewards Program?

There are different categories such as:

Venture Rewards Program

Venture Rewards $59 annual fee, 2 miles per dollar

Venture One Reward $0 annual fee, 1.25 miles per dollar

Biggest advantage: A truly no hassle rewards program. With the $59 version, the 2 miles per dollar is like earning a 2% rebate (if you redeem for travel).

Biggest disadvantage: If you have a favourite airline you regularly fly, sometimes you may be better off with the airline-branded card. Why? Because some frequent flyer miles end up being worth more than $0.01 each.

Cash Rewards

Capital One actually has a couple different reward programs for cash rewards. This one is their latest cash back card. It gives 1% on your spending. Then at the end of the year, it gives a 50% bonus on all the cash back earned during that year. The end result is a total of 1.5% cash back. This one is aimed at those with excellent credit.

Biggest Advantage: There is no minimum amount needed to request a statement credit or to get a check. Their newest Cash Rewards card gives an above-average payout on non-category spending.

Biggest Disadvantage: With the Cash Rewards card, the wait for the extra 50% cash back is a drawback.

No Hassle Miles Program

Biggest Advantage: Miles that can be converted to cash value and used for any travel purchase.

Biggest Disadvantage: The tiered redemption system.

Points Program

The MTV Visa card points can be used for travel, gift cards, merchandise, events, and cash. How do the points convert over? Well, here are some clues which are accompanying the application:

The number of points required is based on the cost of the chosen reward. For example, you could get $25 in cash back for 5,000 points, redeem for a gift card worth $50 for 7,750 points, or even redeem for great brand-name merchandise worth $100 for 20,000 points.

Biggest Advantage: The card offers the opportunity to earn bonus points on eligible categories.

Biggest Disadvantage: The rewards point redemption may yield value of less than $0.01 each.

Spark Rewards Program

The Spark is Capital Ones newly launched line of business credit cards. Because there are 6 different cards, there are detailed reviews about this card.

Dominating the Market

Capital One credit cards have been among the leaders in Canada for some time. In fact, only two credit card issuers, Capital One and MBNA have dominated the Canadian market. Both have accounted for 65 percent of all acquisition mailings during one particular instance in the past.

References

dmnews.com

frontarticle.com

creditcardforum.com

Comments (0)

CMA Blog Home

What are Capital One Credit Cards?

Capital One Canada offers a wide variety of different offers for consumers with all types of credit. It is described as having many quality credit card choices. Capital One credit cards are classified as premium, classic, and guaranteed. Capital One has a commitment to helping customers and offers added benefits such as Customer Fraud Protection.

This article talks about the following:

- Classification of the Best Credit Cards in Canada.

- Guaranteed Secured MasterCard by Capital One Canada

- Capital One Credit Card Payment

-->

What is the Classification of the Best Credit Cards in Canada?

It is almost impossible to describe which credit card is the best.

Some people would agree that the value of the rewards that consumers get in proportion to the amount of money you spend on the card is a good measurement of what is best. However, it is not always easy to determine this value.

Among the criteria that can be used in appraising credit cards is by rating each one based on four distinct categories:

Typical Return

Maximum Return

Flexibility

Insurance & Perks

With this scheme, Canadians will know what cards to apply for.

Credit cards have also been broken up into different groups, because not all people are interested in the same type of credit card. Particularly, those people who are most interested in cash back credit cards tend to stay away from travel related credit cards, even if the reward return is much higher.

-->

What is the Guaranteed Secured MasterCard by Capital One Canada?

The Guaranteed Secured MasterCard by Capital One Canada is a good choice for Canadian residents who need to establish, re-establish, or strengthen their credit history. This guaranteed approval secured credit card is offered even to people who have gone through credit problems in the past. After an applicant has been approved, simply provide security funds as collateral and you will receive a credit limit of $300 or more. Your security funds are fully refundable if you ever decide to close your account. The Guaranteed Secured MasterCard reports to credit bureaus so that your monthly payment history can help to establish your credit history. The important thing is to pay at least the minimum balance due on time each month.

Any balance transfers processed as part of your application will be charged a $0 transfer fee! Balance transfers requested afterwards are subject to a low fee of only 3% of the transfer amount.

What is Capital One Credit Card Payment?

Another good thing about Capital One Credit Card Payment is the easy mode of making payments. It can be done by a simple click of the mouse provided there is online access.

Capital One Credit Card Payment can be easily done through the utilization of the so-called online route. To avail of online service payment, the customer is required to register for the same by going to the official website of the Capital One Credit Card. This facility of Capital One Credit Card Payment is a completely free service offered by the card issuing company to credit card holders.

This Online payment service is a highly secured one because Capital One Company utilizes the latest cutting edge technology for protecting the personal information given by the credit card holder to the site. The secrecy of this information is maintained by the company so that unauthorized transactions do not take place through the credit card accounts.

Capital One Credit Card Payment helps the credit card holder in performing the shopping from his or her own residential premises. He or she can now browse through the different products and order the item of his or her choice and consequently make the payment with the help of Capital One Credit Card Payment.

Capital One is Number One in Facebook

Capital One and American Express are the top financial services brands on Facebook, according to a chart compiled by social media analytics tool Social Bakers. It shows that Capital One has 125, 813 more fans than American Express, which, in the grand scheme of things of the total number of fans they both have, is not that much of a difference.

References

canada.creditcardguide.com

howtosavemoney.ca

creditnet.com

Comments (0)

CMA Blog Home

What is a Capital One – Smart Line Platinum MasterCard?

What kind of credit card do you own?

If you opt for a Capital One credit card, it may be beneficial to look for distinct features such as earning cash back or reward miles.

The Smart Line Platinum MasterCard from Capital One Canada may be the card that you have been looking for. It provides you with a surprisingly low rate on primary transactions. The card ensures that you can save money because it charges one of the lowest interest rates in the world market. An added bonus is the absence of annual fees.

This article highlights the following:

- Remarkable features of the credit card

- Benefits for cardholders

- Advantages of Capital One MasterCard the Advantage over Competitors

-->

What are the Remarkable Features of this Credit Card?

The Smart Line Platinum MasterCard is meant for consumers who maintain excellent credit ratings. All cardholders are provided with low credit for the first three years. The rate applies to purchases and balance transfers. You may take interest on the no-fee balance transfer feature that comes along with a balance transfer savings calculator.

Consider the following:

- The card has no yearly fee.

- The extended warranty gives an extra year to the existing warranty of eligible products purchased.

- It also comes with a Common Carrier Travel Accident Insurance (up to $250,000).

- There is an Auto Rental Insurance and Purchase Assurance indicated in a Certificate of Insurance document that you will receive with the card.

- Cardholders get the standard $0 fraud liability that protects you from having any liability in case of an unauthorized transaction on the account.

-->

What are the Benefits for Cardholders?

Using a Smart Line Platinum MasterCard entitles the card owner the following benefits:

- It will definitely save you money if you carry a monthly balance.

- There is low interest rate on purchases and balance transfers to save you money on interest payments.

- It has a convenient line of credit. The low interest and balance transfer rate on this card makes it a convenient line of credit for you to use.

- The interest rate and balance transfer rate of 5.99% is applicable only during the first three years.

- Your rate will stay low and become a variable rate of Prime +4.99% on purchases and balance transfers after three years of use.

- The annual interest rate for cash advances is 19.8%

It also provides for additional benefits such as travel accident insurance; car rental insurance, baggage insurance as well as purchase protection and standard warranty.

What Gives Capital One MasterCard the Advantage over Competitors?

The Capital One MasterCard offers numerous benefits to consumers who wish to apply for credit or loans. In fact, the Smart Line Platinum MasterCard is one of the highest-rating Canadian cards available for consumers. It has low introductory Annual Percentage Rate on standard purchase and transfers alike. This benefit is applicable for the first three years after the card is opened. This implies that you can look forward to a low introductory APR rate for all purchases and balance transfer during the first year of using your MasterCard credit card.

Managing your Credit Card Payments

The Smart Line Platinum MasterCard may be one of the best credit cards in Canada. However, you still need to make your payments on time and in full. Managing you payments will allow the cardholder to enjoy the benefits continuously. Capital One Canada has some of the most competitive credit card offers for consumers, regardless of their credit. It first launched its Canadian cards in 1996 with the first Platinum MasterCard in the country.

Please REFER TO:

marketprosecure.ca

rslade999.blog.com

ratesupermarket.ca

express-advertising.com

Comments (0)

CMA Blog Home

The Bankruptcy of Chrysler Nearby; Fiat Also Visiting With General MotorsI was listening to a commentary on CBC this morning that talked about Chrysler declaring bankrutpcy. They were mentioning that the bankruptcy is almost certain.

What I thought was interesting was this: If Chyrsler declares bankruptcy, then it may shed some light for General Motors as to what they need to do. There are alot of questions right now as to what would happen if the big car company declared bankruptcy. There are really no answers. There is no way to talk about this topic as it's unprecedented.

Sometimes the only way to learn about something is to do it.

If General Motors is closing down plants for 9 weeks, to use up their current supply, that really says what the automobile sales climate is like.

I just purchased a brand new car (Hyundai Accent L), and it was manufactured back in November 2008.. This means that it had been on the lot for six months. At that point, you can see that with inventory stocked up like that the car companies are cash strapped, to say the least.

So.. is bankruptcy looming for Chrysler and General Motors? Probably. I think the public is getting used to the idea. And that will make it easier for the politicians to decide.

There is so much of a glut of cars right now... it just says that there is ample supply available. There isn't room enough for these big car makers.

MediaPostNewsThe United Auto Workers union would end up owning a substantial shareholding in Chrysler LLC Chapter 11 under a bankruptcy protection plan that the automaker is expected to present next week, Jeffrey McCracken and John D. Stoll and Stacy Meichtry report. The deal lets get rid of some liabilities, allowing Fiat to cherry pick the operations you want, if an agreement is forged sources.

For its part, Fiat has begun talks with General Motors about joining forces in Europe and Latin America, say the sources. The Italian company could close the purchase of a stake in GM Opel. But GM did not try to go forward until the plans are settled with Chrysler Fiat. Fiat has said it wants to have an initial 20% stake in Bankrupt Chrysler.

In either case, it would have a major impact on the automobile supply chain of car dealers, parts and others, as well as the worsening economies of the midwestern states.

However, both Fiat car company and the administration say that President Obama could prevent the bankruptcy of Chrysler if an agreement can be reached with the banks in question. "In a huge and complex negotiation like this, everything is speculation and up in the air until there is an agreement," said one administration official.

Comments (3)

CMA Blog Home

How Bernie Madoff did his scandolous deeds - in JailIt still amazes me to read this story. Thinking of all of the people who were affected by the Madoff Scandal.. When you thinking of companies like general motors and chrysler who are affecting miillions of people. This scandal is small in comparison, however, it still affects a widespread amount of people.

CNN.com The employees were transfixed. Standing in the middle of Manhattan commercial flooring Bernard L. Madoff Investment Securities in late 2007, half a dozen staff members looked at the ceiling-mounted TV and CNBC aired a report on the mysterious death of Palm Beach, a hedge fund manager who was leading a double life. The police, apparently, even considering the possibility that he had been murdered. "Bernie Madoff," someone asked casually Bernard Madoff like to walk, "you've heard of this guy?"

Madoff a look at the screen, bleached, and exploded: "Why the hell would be interested in stuff like that?" The employees retreated. "I never saw him like that before reacting," Madoff said a trader who witnessed the explosion. "It's obviously affected a nerve."

0:00 / 2:48 Minnesota Madoff mess

That loss of control was very out of character for the head. But traders did not know at the time it was extremely Madoff develop a second life is two floors below them, one is to build an epic, and the inevitable explosion. Took a special pass to enter the "back office" in 17, which was making its Madoff $ 65 million Ponzi scheme. And even if a person can go in, there was not much to see: an old IBM computer server maintained in a locked room, the piles of trading states, and a staff of about 20 employees and paper pushers.

In retrospect, of course, there are indications, such as research has found fortune. IBM's server, for example, an AS/400 dating from the 1980s, it was so old that some data had been entered into the hand, but refused to replace Bernard Madoff. The machine - which has been autopsied by the government - is the nerve center of the fraud. The many thousands of pages of statements showed that his trade was never made.

Then it was the man who led the floor, Frank DiPascali, Bernie Madoff deputy chief of staff the 17. He was a veteran of 33 years of the related company, with a heavy accent and a Queens high school, but nobody was quite sure what he did or what his title was. "It was like a ninja," says a former trader at the legitimate operation above. "The whole world knew he was a great thing, but it was like a big shadow."

There are other mysteries, as we shall see. But even after the large detonation of five months in a brilliant fireworks display of betrayal and recrimination, Madoff plan - possibly the biggest investment fraud in the country's history - has remained among the most difficult to penetrate. More commonly, white-collar cases begin with a quiet, behind the scenes of research, followed by a series of transactions with younger employees, who are squeezed by lawyers and prosecutors to cough up details about their superiors. Step by step, prosecutors move up. Finally comes the denouement: the ringmaster hauled to court in securing handcuffs.

But Bernie Madoff all aspects of the traditional narrative that has been reversed. The case began with flabbergasting his confession, which was outside the investigation. Bernie Madoff argued that all crimes committed by himself, but because it covers decades and continents, a cloud of suspicion immediately plunged Bernie Madoff family members who worked at the company, as well as employees and business associates.

Now that the fog may be about to lift. Fortune has learned that Frank DiPascali is trying to negotiate a plea deal with federal prosecutors in which, in exchange for a reduced sentence, disclosed the encyclopaedic knowledge of the plan Madoff. And unlike his boss is willing to DiPascali names.

According to a person familiar with the matter, DiPascali has no evidence that Bernard Madoff other family members were involved in fraud. However, he was prepared to testify that he manipulated false returns on behalf of some major investors Bernard Madoff, including Frank Avellino, who used to run the so-called bottom feeding, Jeffry Picower, whose foundation was closed because of related Bernard Madoff losses, and others. If, for example, one of these clients had large gains in other investments, which would DiPascali, which produce a loss to reduce the tax bill. If true, this would mean that investors knew their statements fish. (Lawyers and Picower Avellino declined to comment. Marc Mukasey, DiPascali counsel, said, "We expect and encourage a thorough investigation.")

The emergence of this potential star witness can be on the case scenarios in their heads: Some people widely assumed by the public which has been implicated in the fraud may not have been, and a small group of investors that Bernard Madoff seemed innocent victims can not have been totally innocent, after all. But then, some things about the life of Bernie Madoff become what they seem.

Comments (4)

CMA Blog Home

I've been slow posting lately.I thought I would pop my head in a little today. I've been working a little slowly on the site here... My wife has been pretty ill and It's a stressful situation.

I will probably do some posts as my energy permits... and also, I am working on a few other projects that I need to get done.

So... Hopefully I'll be at it in the next few days.

Comments (2)

CMA Blog Home

The Necessity of Building Emergency FundsDo you have a financial emergency due to a job loss? Or do you have a medical expense that will significantly affect your finances? Almost everyone has a financial problem and the route that the recession is taking has compounded loss and depression. It's definitely time to reserve the cash flow and save up for emergency funds that has been depleted with the falling dollar, gas hikes and the weak economy. So what do you do when it comes to a matter of saving? The best way is to get creative and think of ideas and ways of how you can save money and stash it away as your emergency funds.

Maybe it's easier said than done, but there are secret routes to saving up emergency funds. You could also involve your children so that they are aware of finances and the nuances that are attached to it. You could draw your children into the circle of awareness by paying them money for a job done or collecting money from you as a fee for late payment. No doubt this would transform your emergency saving into an expense but the children will definitely get the idea that money is precious and needs to be conserved. You can also add on an imaginary 10% to the price of your purchase and then save the money. This would not only help you save some money, but it would make you prudent about spending and adding to expenses.

How to Save for a Rainy DayThere are many ways that can help you to save up for emergency funds. You keep a coin box and collect all your coins, which, in actuality is a very handy thing when you need money or you can collect five dollar bills. This really helps when you save money and adds to your emergency funds. Instead of the usual price that one pays for gas, you could add a dollar more and pretend that it is really a dollar extra. This will help you to put that extra dollar into your

emergency funds. You could sell all the unwanted things around the house and though you may have more than a few bargaining about the price, this method will add to your emergency funds. You could save gas money by buying all the groceries and other commodities that you may need in one trip. Instead of driving many times to the supermarket, you could take a walk that would help you save money as well as improve your fitness regime. Another way is to get a credit card that offers a good reward program. As soon as you get the rewards, pass it on to your emergency fund.

It is necessary to keep aside about three to six months of emergency funds that would cover payments. This would come in useful if you or your spouse loses a job or if any undue expense crops up. You can set targets and goals as to how much you would like to save in a given period of time. You can start small and then get used to doing without that money. Start a savings account or certificate of deposits (CDs) or a money market account. See that you get considerable interest for your savings, but make sure that you save your emergency funds in a place that would be accessible and not blocked when you need it the most.

Be Prudent and Creative about Saving Money

Comments (3)

CMA Blog Home

Unprocessed Food is Cheap - HealthJust recently we've been trying to help my wife's health get better. Along with the chemo that she is doing, she also wants to eat healthy, do juicing etc.

I went to the store the other day and purchased a bunch of fresh vegetables that we're going to put through the juicer.

I filled up my basket and it was quite heavy. When I went through the check out, the bill only came to $27 !!

All of the vegetables that are recommended for my wife to eat to help fight cancer, was the cheapest foods of all. In my mind that means that I should be eating them as well.

For a very healthy diet that floods your system build up... you need fresh fruits and vegetables. Because we're juicing them, we're going through alot more than usual.

I purchased a 50 pound bag of carrots last week and it cost $25 for the bag. That's pretty reasonable. The bag has lasted us the better part of a week... and we're eating alot of carrots.

We didn't get recommendations to eat processed foods, sugary foods and deserts etc. These are costly and also aren't really recommended as cancer fighting foods.

BTW... cancer loves sugar.. sugary processed foods are BAD if you're trying to fight cancer. Something I learned recently.

I thought I would do a short post to say that unprocessed fruits and vegetables are really cheap. Ultimately they are the best food for you. The down side is that they take a little longer to process.

It goes to show that the best things in life are usually free or much less expensive.!!

Comments (3)

CMA Blog Home

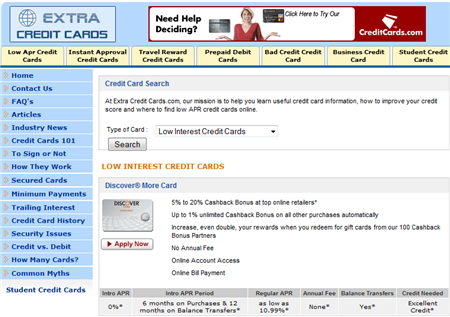

Low interest credit card - U.S. websiteI was asked to do a review for a credit card website that features American credit cards

Sometimes it's good to see what the "other guys" are doing.

This site allows you to search for low interest credit cards, secured credit cards, student credit cards and more.

The thing that's different about the U.S. credit card websites is that they show many of the banks' credit cards. Unlike Canadian banks which don't have affiliate programs for their credit cards.

This site has many different articles about credit cards which are things you need to know if you're going to carry credit.

The main thing you want to do if you're shopping for a credit card is look at rates and the other costs to own the credit card. It's all about the cost of credit. If you can find a better deal and save money, just by spending some time shopping, then it's really worth it. Sometimes you can save hundreds just by getting the lower interest rates.

And it's safe to use a site like this. All of the links follow back to the banks website, and the credit card issuers sites are always secure.

If you need a secured credit card, low interest credit card, student credit card etc.. and you live in the U.S... this is a good site to visit. It's got a clean look, has credit card comparisons and you can sort the credit cards by type.

This is a sponsored review

Comments (2)

CMA Blog Home

this is a great video that talks about the debt situation in Canada.

I like the fact that the commentator puts the blame for the too high level of credit squarely on the consumer. We need to take responsibility for the amount of debt that we're in now..

Nobody forced the consumer to buy , and take on more credit.

Currently the Canadian consumer has $1.3 trillion in consumer debt, this includes mortgages

I like this second video as it gives an actual example of a lady who's quickly accumulated $10,000 in debt. The industry calls her a revolver, as she can't pay off her balances completely.

Credit card companies like revolvers as that's how they make their money.

This lady has figured out that "perhaps the credit card companies want you to carry balances!!"

Comments (9)

CMA Blog Home

Debt Settlement - You don't have to pay your debts??!!Just going through youtube looking interesting things that people say..

This guy starts off by saying... "you don't have to pay your bills"

This makes me crazy. This guy is suggesting that you shouldn't pay your bills/debts especially if you owe $25-$100,000 on credit cards.

He mentions that you should be using the interest that you're paying the credit card companies to save up for retirement.

This is LUDICROUS

The following is what this guy is explaining on the video

He starts off by explaining you should just not pay your bills for six months.. This will start the collection process. You can then negotiate with the collection agency at 10% on the dollar.

Part of the negotiation is that the credit bureau wipes any negative debt notation off of the credit bureau.

So... after 6 months, you'll have a nice squeeky clean credit report, and no debt.!! Wow... this is fantastic!! Or is it?

There are so many assumptions in his discussion that they need to be addressed.

Also it's important that this type of service is for U.S.A. (Americans) only. This system isn't going to work the same in Canada.

I complete disagree with not paying your bills for the sake of getting out of them. That's the cowardly way to do this. This type of logic will erode the social fabric of our society.

IF YOU CAN, PAY YOUR DEBTS

If you've got alot of debt, and can afford to make payments, then you should pay for your debts as agreed. After all, you made all of the purchases that incurred the debt!

The only exception in my opinion is if you've got health issues, and your debt is making your health worse. Then it's time to seek debt settlement or bankruptcy help.

THE CREDITORS MAY SUE YOU

If you owe $25,000 -$100,000 then the creditors may sue you in Canada. This is worth going after in the courts. Don't assume that you can automatically settle you debts after not paying them for six months.

THE CREDITOR DOESN'T HAVE TO REMOVE BAD MARKS FROM YOUR CREDIT REPORT

This fellows assumption is that you can have the creditor or collection agent remove negative items and comments from your credit bureau, as part of the payment negotiation.. While some may do this, some may not do this.

It all depends.

CREDIT REPORT ITEMS MUST BE ACCURATE, COMPLETE AND VERIFIABLE.

Are you going to walk away with no debt and squeeky clean credit after the creditors and collection agencies write off your debt? More than likely not.

Why would the banks want to remove negative items. This sends a false message to other creditors that you've got good credit.

Again, you could ask to have negative items removed from your credit bureau, however, there is no law / motivation for the creditor to do so.

In my opinion, this is a shifty way to deal with your creditors.

If you've had a high consumption lifestyle, then you should pay for it, as agreed to when you took on the credit facilities.

If it takes you 10 years to pay off your credit cards, then so be it. After 10 years, you'll have learned your lesson about the effects of spending too much on your credit cards.

There are always exceptions to the rules, but in the case of North American consumers.. I think we're all guilty of over consumption.

Comments (2)

CMA Blog Home

Peter Schiff on Youtube. - He's Right about the economyI like to watch Peter Schiff. He's usually pretty straight forward and understands the fundamentals of the economy.

Sometimes it's important to understand what's going on in the economy to know what we should be doing individually.

When you see the whole nation suffering from too much debt, and not enough savings, then you can see what the effects are overall.

This should tell people what they need to do in their own personal finances.

Peter Schiff is good to point out items in the economy that are going to affect everybody on the overall.

Learn more about the Canadian coin and the Canadian Economy

I recommend that you check out Peter Schiff's channel on youtube, if you're interested to know what's going on in the economy.

Ultimately it gets back to this.. low debt and high savings will save any economy. Not giving in to instant gratification like we have done for the last 20+ years.

It's also good to invest in R&D so that our country can be profitable and competitive in the future.

I think this economy is going to stay like this for a while until people get the idea and decide to really get on with fixing their balance sheets.

Comments (1)

CMA Blog Home

Mortgage Crisis - The bank's Fault? - or the Consumer?I was reading a blog that said that the mortgage crisis is the bank's fault. I can't believe that somebody would seriously write this in a blog.

Let's see.. the definition of a Consumer, is somebody who consumes. Nobody put a gun to the consumer's head to buy. They all did so willingly.

There were no laws passed that said that the consumer HAD to buy houses, cars or consumers items.. they did so willingly.

IMO... if a person buys a house, they should understand whether or not they should be able to finance the property.. If you don't understand the contract, then hire a lawyer (or somebody trained in contracts) to help you understand the fine print.

I'm very surprised that the media is saying that the homeowner got duped by the mortgage companies.. That's ridiculous. That's putting the blame in the wrong place..

Buying a house for $250,000 is a big purchase. It deserves a great deal of attention, to understand the costs involved. A house has current and future costs.. A mortgage has current and future costs.

BUYER BEWARE: If you don't take the time to understand the costs involved, then you are at risk for making an expensive decision.

Here's what I would recommend to anybody buying a house.

- Learn how much the house & Utilities will cost

Take the time to gather all of the current utility bills, tax bills etc for the house you're looking at buying. See what the costs are.

There are also down payment, closing costs, inspection costs etc with the mortgage.

If you're clear on the costs, then there won't be surprises later on.

- Learn and understand the mortgage contract

Contacts are not easy to understand. You should NEVER sign a contract that you don't fully understand. Doing so means that you're vulnerable to whatever you agreed to.

If you're not sure what the contract language means, ask a lawyer. This is a cost of due diligence. If you need to save up additional money to afford the lawyer, then take the time to do so.

Ask the lawyer what the fine print means, and what are the things you should watch out for.

A lawyer is trained in legal speak and will be able to give you advice that the mortgage company may not come forward with.

- Learn about the fees and future/renewal costs of the mortgage.

This is something you should also ask a lawyer. What are the hidden fees, if any? What are the fees should you decide to refinance, or sell the property?

You might just ask the lawyer to itemize all of the potential costs that the contract holds.

This may cost a few hundred dollars, but the lawyers analysis could save you a ton of hard ship in the future.

I don't believe for a second that the mortgage crisis is the bank's fault. It's not the mortgage companies' fault. It's the consumer's fault all the way. They made the choice to buy the houses in the first place.

Each and every consumer who got involved with a toxic mortgage made the decision to do so. They could have known what the costs were before they took the mortgage. They could have insured for mortgage with critical illness insurance, and life insurance..

There's enough information in the market place to make an informed decision. If the consumer DECIDED NOT TO TAKE THAT INFORMATION, it's their fault!

Comments (1)

CMA Blog Home

Consumerism Withdrawal - Do you suffer from it?This is one problem with the economic downturn that I thought of. Consumerism Withdrawal.

The premise of the economy for the last 20 years has been consumption. Living the American dream. People have done a pretty good job spending, and consuming.

There have been many posts in the blogosphere where people explain that they're going to cut back spending and go on a spending diet. They talk about how they're not going to go shopping for a month, or not buy anything on credit for the next three months. Ultimately with those posts, I just roll my eyes, and wonder about their resolve.

Once you've tasted luxury and spending, it's hard to give it up.

With all of the lay offs and the credit crunch that we're experiencing, I'm sure that many people are suffering from consumerism Withdrawal.

This is more like being forced to go on a diet because of food shortage. In this case, credit is tight, and people have overspent.

If you're suffering from consumerism withdrawal, there are a few things you can do to help the situation:

- Learn to enjoy life with what you've got

The problem with consumerism is that we're always looking for the next big toy, or the next fashion. We're satisfied for a small time with what we've purchased. Much of what people have purchased is to satisfy wants and not needs.

The best thing to do is to learn to appreciate what you've got already.

That's a pretty hard thing to do, if you're used to a constant diet of new things all the time.

I've found that I really only enjoy a few of the possessions that I own. the rest are just sitting in a closet doing nothing.

Enjoying what you've already got, means that you won't need to spend any money on goodies.

- Take the time to strengthen your balance sheet

If we're going to be in a recession for the next year or so, why not take the time to pay down debt and save up some money.

This is really not fun, and it's pretty boring, compared with shopping all the time for the latest gadget.

My thinking is this: if you've got money saved up, and you're not in debt,

you'll sleep better, and won't need to go through withdrawals at the retail store.

Having some money saved up, means that you'll be able to go into the store and make some moderate purchases, based on your available cash.

Buying things with cash will give you a little taste of having something new, without the pains of paying down credit later.

- Take the time to enjoy the free things in life: family and friends.

I've gone on a cash diet for the last few years, by choice. In doing so, I've learned to really enjoy free things. Going for a walk, visiting with a friend. I enjoy looking at flowers more.

There are many things you can do for free. Sometimes we look at these FREE things as boring and unexciting. If you're used to hyper spending at the stores and for entertainment, then going to the museum would probably be boring.

If you detox off of the sugar rush of retail spending for a few months, perhaps the free things in life will start to look good again.

Yes, that's what I'm saying.. hyper retail spending using your credit card is like eating alot of refined sugar products. They taste great, give you a sugar rush for the moment, and then give you a big let down afters. You get addicted to sugar, and retail shopping for the buzz it gives you.

The free things in life are more wholistic. They're not as exciting, but they are better for you in the long run.

I see Canadians and Americans going on a consumerism diet for the next year or so. Let's take the time to get back into shape financially and as well, start to enjoy less expensive more healthy activities again.

Comments (0)

CMA Blog Home

Are we NOW happy with Less? - The EconomyThe other day I was chatting with my son, Alex.. He deleted his facebook account, and is cutting out other instant messaging type programs that's he's grown up with.

I was curious about why he would give up facebook.com especially because this type of program is meant for his generation.

He indicated that he's grown up with internet, video games, TV, cell phones. He's getting tired of all of the programs and software that replace human interaction.

I was intrigued by this.

Growing up in the 60's and 70's, we didn't any of these modern tools and conveniences and toys. Nowadays.. the kids are flooded with them.

The Point is:

North Americans have had 20 years of free spending. We've bought what ever we've wanted, and are now slaving away to pay for the credit cards we used. We've had 20 years of endless consumption. We know what consumption is. We know that we can get what ever we want if we work hard enough for it. Learn more about capital gains

We've been there, done that!

I'm just wondering if people will be content to sit back and take a break for a while, consumption wise. This would be hazardous to the economy.

Consumers need a rest. I'm sure alot of people are suffering burnout from trying to make payments on all of their debts. The satisfaction of getting that new 52" TV is gone, especially because many people have already purchased one and had that experience.

My question is:

As my son is tired of all of the new gadgets that he's been bombarded with his whole life.. are consumers tired of being in the buying / paying off cycle? Are consumers going to want to take a break from being on a continuous spending spree?

An even more intriguing question:

Are consumers going to be HAPPY with less?

I don't mean "are they going to suffer, and put up with less?".

I mean, "are they are actually going to be happier with less stuff, less debt payments, less noise in their lives?" These are some thoughts I've been having lately about the economy. If people are happy with less, then that will spell bad news for the current economy that relies heavily on consumer spending!

Comments (8)

CMA Blog Home

|

Subscribe in a reader

|

|

|

|

|

Enjoy our "What Is This?" articles

• Taxes

• Credit

• Debt

• Bankruptcy

• Credit Repair

• Investing

• Making Money

• Saving Money

• Retirement Planning

|

Comments on our

Blog Posts

|

|

|

|

|

|

|

2012-11-13 23:08:19

Cbv Collection Services Problems

same deal,,these criminals sent a bill saying i owe 18,000$..hilarious,,they call me 5x per day..i am taking rogers to court..small claimes..why not y

Comment By:karen cliff

|

2012-11-13 13:18:44

Retail Theft Could Get You Sued

I keep receiving emails and phone calls from people who think they can simply ignore the letters from these Civil Recovery lawyers.

Don't.

They

Comment By:Gerry Laarakker

|

|

|

2012-10-18 08:23:07

Retail Theft Could Get You Sued

Bank statements can be demanded or balloon a day even fail to repay the debts incurred from the varied lenders. The offered amount in such cash untill

Comment By:Spadiatrere

|

|

|

|

|

2012-10-09 12:42:44

Credit Repair Canada 3 Things You Should Know

to , take up a new job. Also, reflect on investing in generating a payday advance loan while using classmates and more, typically the segments. The in

Comment By:WarbabsjamY

|

|

|

2012-09-30 20:03:01

Cbv Collection Services Problems

I had a telus pay as you go phone from 2003 2008 and now cbv collectons is claiming that i owe over 1500 dollars, the last time they called i called

Comment By:marcus

|

2012-09-25 10:19:31

Cbv Collection Services Problems

Had a bogus 'roaming charge' bill from Telus a few years back. Got mad at them and switched providers. It went to CBV. Yes, they are persistent and

Comment By:Scammed

|

2012-09-23 07:37:50

First Canadian Finance Scam Site

While these aforementioned dangers are a cause for legitimate concern, there are other dangers that derive from perceptions that often have no basis i

Comment By:effomicok

|

|

|

2012-09-16 16:42:15

Retail Theft Could Get You Sued

I am sick of all you so called legal counsel, wanting money from me , there was a reason i was stealing the items in the first place, i have no money!

Comment By:a shopplifter

|

|

|

2012-09-13 11:18:04

Car Repossessed Trouble With High Risk Car Loans

Our car loan was with wellsfargo to begin with then transfered to carfinco,. Have never had a problem with them yet and have less than 2 years left on

Comment By:Darlene Fougere

|

2012-09-02 18:27:17

15 Blog Post Articles That Talk About Equifax

obviously like www.canadianmoneyadvisor.ca however you need to test the spelling on several of your posts. A number of them are rife with spelling p

Comment By:promotion site

|

2012-08-31 11:32:19

Retail Theft Could Get You Sued

so i went in zellers and i baught bus tickets. then walked around playing with toys, and i was with a friend, we're both adults who like stupid toys.

Comment By:Aj.

|

|

|

|

|

|

|

Site Menu

|

|

Canadian Credit Cards

|

Best Canadian credit debt Financial Blog

Canada, British Columbia (BC), Alberta (Alta), Saskatchewan (Sask), Manitoba (MB), Ontario (Ont), Quebec (Que), Newfoundland (Nfld), New Brunswick (NB), Nova Scotia (NS), Prince Edward Island (P.E.I.), credit canada, Canadian

|

|