Canadian-Money-Advisor.ca BLOG

Does Not Carry a Balance

SEE ALSO

References

External Links

Comments (0)

CMA Blog Home

Comments (5)

CMA Blog Home

Good Credit - (Canada)

SEE ALSO

References

External Links

Comments (0)

CMA Blog Home

Best Balance Transfer Credit Cards Canada

A credit card balance transfer basically is moving the debt from one particular card to another credit card. It is regularly an excellent technique to set aside money for savings. Various credit card companies offer an interest free period on balance transfers to new clients. This is the common promotions that card issuer gives to be able to attract more new customers. Clients can merge their payables by transferring the balance from more than one card or be able to get a new credit card having lower interest rate. Switching to a credit card that does have 0% balance transfer can provide a huge savings for the card holder for a period of 16 months.

Most clients have specific goals and objectives when they are using balance transfer credit cards. Usually, card holders are searching ways to lessen their high interest debt; however, clients are maximizing their full financial prospective by leveraging all their assets, as well as maintaining a good credit score. Commonly, card applicants pick best balance transfer credit cards Canada offering no interest charging for introductory balance transfers. In addition, client have learned that transferring credit balances and deposit them into high interest bank savings accounts would allow them to earn free money. Several card issuers guarantee the new clients that balance transfer process would be very quick by allowing the card user to demand a balance transfer check payable to the full credit limit set with the credit card.

On the other hand, card issuers appear to be slowly phasing out profitable no balance transfer fee offers. 0% balance transfer fee opportunities provided by the card issuer will not be available most of the time as banks and card companies do change their credit card promo and benefits. As a tip to the card applicants, always remember to read credit card terms carefully and compare it with other credit card from the different card issuers.

Good Credit - Excellent Credit

This will talk about actual best balance transfer credit cards Canada from different issuers that give low interest rate. What is common about these credit cards is that they are giving 0% balance transfer fee for a certain period. The time spans before the special interest rate goes back to its permanent rate usually are up to 18 months. Try to check each card feature and benefits and compare one another. In this way, you can choose or pick the best balance transfer credit card that would help you save much cash over your credit spending.

Overview

These cards are for those individual who are using credits. These individual want to carry a balance on their credit card and have the lowest interest rate possible for balance transfer as well as other card transactions. Credit cards with low balance transfer rates are for those card applicants that have established an excellent credit history after using credit cards in the past.

Carry a Balance - Lowest Interest Rate

MBNA Platinum Plus® MasterCard® Credit Card – 1.99% for 10 months

Having a good credit brings immense benefits. In addition to a low initial Annual Interest Rate on best balance transfer credit card Canada and doesn’t charge any annual fee, this MasterCard offers a high credit line to clients qualifying for this card. But this would be available for those card applicants who have good credit history as well as with its credit rating with their other credit cards. This Platinum Plus® MasterCard® credit card has a low 1.99% introductory interest rate for 10 months on Balance Transfers and Cheque Cash Advances.

Other features of the card are listed below:

• No Annual Fee that gives less burden on payment obligations.

• Credit limit up to $100,000 and could be stretched further if you are a good creditor.

• Emergency replacement within 48 hours for lost and stolen cards are free of charge.

• Online access to your credit card account is available by just login in the internet with secured login password.

• International acceptance at millions of locations around the world even in diverse areas

• Around-the-clock fraud protection that gives assurance of safety and risk-free for the clients.

• Immediate cash access at 430,000 ABMs internationally

• 24-hour customer service team that is always ready to help.

• Emergency services like lost document and ticket replacement, lost luggage assistance, travel accident insurance, auto rental insurance are also catered on the services of the company.

• Best Balance Transfer Credit Cards Canada

MBNA Gold MasterCard® Credit Card – Fixed 9.99% AIR

Clients who are not eligible to have the Platinum Plus® MasterCard® credit card could avail for this good credit card. This has a common feature with the Platinum Plus® card but a difference in their interest rate exists. This card has a fixed 9.99% annual interest rate. This card is still considered as a good and preferable card for clients. Using this card for a certain period of time until making an excellent credit history won’t get you into trouble in paying your balances along with the interests but instead, it makes you a candidate to apply for the best MasterCard credit card that is available.

Here are some features of the credit card:

• No Annual Fee for the card holder.

• 9.99% Annual Interest Rate on Purchases and Cash Advances are offered and is considered a fair rate for the client.

• Around-the-clock fraud protection that gives assurance of safety and risk-free for the clients.

• Online access to your credit card account is available by just login in the internet with secured login password.

• 24-hour Customer service that is always ready to help.

• Immediate cash access at 430,000 ATMs internationally

• Emergency services like lost document and ticket replacement, lost luggage assistance, travel accident insurance, auto rental insurance are also catered on the services of the company.

Capital One® Platinum Prestige Card

This card requires an excellent credit history which means that card applicants who are eligible are only those who have build up an excellent credit history. This card has a 0% annual interest rate only for purchases and balance transfer until May 2011. Clients would get more savings for this card due to the 0% APR. However, once the date has passed, everything will be back to normal. So, for clients who are planning to have this credit card, maximize the features of this card by using the card as often or most of the time before the due date will be reached. Best Capital One Credit Card Canada

Here are extra benefits of the credit card:

• No annual fee is charged for this card.

• 3% interest of the amount for cash advances but not less than $10.

•Travel benefits offered: Master RoadAssistTM, MasterCard Global ServiceTM, MasterAssistTM Travel Assistance Service for client safety all the time.

• Travel accident insurance is also given aside from the safety assistance.

• MasterCard PayPass™ give convenience in paying bill for the card holder.

• Tap-to-Go system when using the card to have less hassle from card swiping.

• 27/7 standby customer service to phone or online.

• $0 fraud liability is assured for unauthorized card holder using the credit card for any transactions.

• 3% interest on balance transfer after May 2011.

• After May 2011, the APR returns back to 24.90% on cash advances and 11.90% on purchases.

Capital One SmartLine™ Platinum MasterCard

This is one of the best credit cards that Capital One offers. But this credit card requires an excellent credit history. This means that with your past credit card usage, you must not have any single penalties acquired and your credit rating must be high. The interest that comprises this card is at 5.99% which is best for individuals that save money on interest. This card is composed of great benefits that would give the card holder maximum convenience it can offer.

More features of the card are listed below:

• No Annual Fee which means less responsibility on payments.

• 19.8% interest on Cash Advances is not good rate for this kind of card service.

• 5.99% on Purchases and Balance transfers guaranteed for 3 years. This must require the card holder to sustain agreement status. The interest rate switches to a variable rate of Prime +3.75% on purchases and balance transfers after 3 years of being a card user for the company.

• Balance transfers don’t entail any fee or charges.

Citi® Platinum Select® MasterCard®

This is an attractive credit card only for clients who do have good or excellent credit history. The introductory interest rate offers start with the best balance transfer credit cards Canada which is 0% as well as on purchases for 18 months time. This card doesn’t have any annual fee charges. This card allows a lot of savings for the client for a specific period of time. However, after the 18 months grace period given, the card users still can save but not as much as having the introductory rates. List of additional benefits are given below.

Here are the features of the credit card:

• Having the card you may become eligible for an unsecured card after 18 months of card usage.

• $0 liability on unauthorized charges made into the client account.

• Citi® Identity Theft Solutions protects the account and personal information of the card holder.

• No required income or co-signer to start building a record of account performance.

• With retail purchase protection, the items purchased with your card are safe against accidental damage or theft for up to 90 days from the day the product is bought.

• Tap-and-go system of Citi MasterCard® Payment Tag with PayPassTM is a new innovation where you just tap your card rather than the old system of swiping it.

• Citi® Credit Card Benefits & Services offers cash or rewards such as American Airlines® awards and travel benefits to cash back and college saving.

• APR on purchases is as low as 9.99%.

• 3% interest rate for cash advance and balance transfer with a minimum amount of $5.

Chase Freedom Visa $100 Bonus Cash Back

This credit card gives many rewards to the client starting from the cash back of $100 during the first purchase of the card. It has 0% introductory annual percentage rate and no annual fee being charged for this Chase Freedom Visa to its user. Check out the additional benefits offered for this card.

Chase Freedom Visa offers you more benefits:

• 5% cash back offers is returned to the card holder when purchasing gas, home improvement and department stores.

• Get additional 20% cash back when buying with the specific merchant online using the Chase credit card.

• 1% cash back for all the credit spent – no spending tiers or caps on how much you can earn.

• $50 bonus cash back during the card first purchase.

• No annual fee as well as introductory APR.

Chase Slate Card

Slate from Chase credit card gives you the capacity to propose your own payment arrangement. There are four ways to pay off your balance and these are the following: Full Pay, Split Pay, Finish It and Track It. Full Pay allows you to keep away from paying interest on everyday items, such as gas and groceries, when you pay settle your balance each month. These are routinely divided on your billing statement. Split Pay allows you to pay off larger purchases on your own provisions, you create a date or do monthly payment and these items will be made into half reflected on your statement. Finish It allows you to pay down your whole balance sooner by making a date or paying at the end of the month. Track It allows you to take note of your transactions and check your payment development in real time.

The introductory period is based on the application and level of credit history. If you qualify for Elite and Premium Pricing, you will be granted a 0% APR on purchases and balance transfers for the first 6 billing cycles following the opening of the account. If you qualify for Standard Pricing plan, you will enjoy a 0% APR on balance transfers for the first 6 billing cycles of the account opening.

Chase credit card offers the following as additional features:

• 0% APR up to 12 months is offered by the card issuer.

• The APR on purchases is at 11.24%.

• When having cash advances, the APR is at 19.24%

• No annual fee is charged to the card holder.

• Balance transfers have an interest of 3% with a minimum of $5 while cash advances have a minimum of $10.

• Dedicated service advisors are on standby 24/7.

• No annual fee charge even if the card company is giving all the card benefits it can offer.

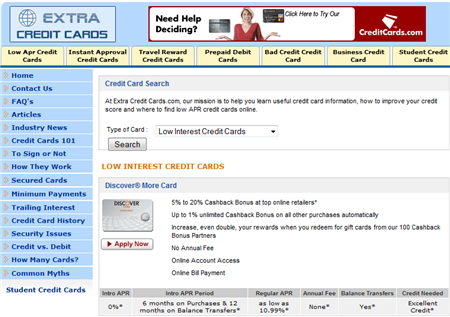

Discover® More® Card

This credit card gives the card holder 0% APR for 12 months and 6 months for purchases. The company only charge regular APR for only 11.99% which is low compared to other credit card issuer’s rates. The card doesn’t have any annual fee which is an extra saving for the client. This card has mentioned some of its feature and benefits. Check out more of it below.

Other benefits of Discover® More® Card:

• No uncertain intro terms are assured for this kind of credit card.

• 0% APR on Balance Transfers for a full 12 months and once exhausted, regular APR is just 11.99% low compared to other cards.

• 0% APR on Purchases for a full 6 months is guaranteed by the company.

• 5% Cash back Bonus in categories like travel, gas, groceries, restaurants, home improvement stores and more are returned to the card user.

• Up to 1% unlimited Cash back Bonus on all other purchases using the credit card.

• No Annual Fee charged to the card holder.

Permanent Rate

Permanent rate is what is charged by the credit card issuer throughout the life of the agreement that a client have agreed on. It doesn't fluctuate like the promotional interest rate in which it is offered for a certain span of time and after which, the rate will return to its regular interest rate. Permanent rate as you can check with the various credit card issuer differ in value. This is because of the type of card and the features that comprise such card. Usually, credit cards that offer high credit limit or balance have a higher rate because the risk that the bank or card company is facing is greater compare to secured cards which are safe and less risky.

Promotional Interest Rate

A promotional interest rate is a low interest rate which the credit card issuer will charge for a given period to an existing card holder, usually 6 months, to give incentive for the existing customer to transfer over balances to their card.. Example: The interest rate could be as low as 1.99%

Transaction Fee

This is what is charged with some cards when the individual does a balance transfer.

Example: MBNA charges 1-2% of the balance transferred at the time of the transfer.

$10,000 x 1% = $100 which is billed to that month's statement

Introductory Interest Rate

This is the same as a promotional interest rate, but will be used by the credit card issuer to give incentive to new customers to apply for one of their credit cards. New applicants only. The period is usually 6 months, and the interest rate could be as low as 1.99% depending on that individuals credit history.

After the introductory period is finished the interest rate will go back to the Permanent Rate

See Also

Best Credit Cards Canada

Best Cash Back Credit Cards Canada

Best Capital One Credit Cards Canada

Best MasterCard Credit Cards Canada

Best MBNA Credit Cards Canada

Best Visa Credit Cards Canada

Best Secured Credit Cards Canada

Travel Credit Cards Canada

Balance Transfer Credit Cards Canada

References

Carry A Balance Cards

What is an APR?

Finest MBNA Credit Cards

Carry A Balance - Credit History

External Links

List of Top Visa Credit Cards

Canadian Credit Cards

FCAC - Best Credit Cards in Canada

BEST BALANCE TRANSFER CREDIT CARDS CANADA

Comments (13)

CMA Blog Home

Balance Transfer Credit Card Canada

What is a balance transfer?

From Financial Consumer Agency of Canada:

A "balance transfer" is the amount of money that is transferred from one credit card to another. The purpose of a balance transfer is to pay your balance off on an existing credit card by "transferring" the balance from your old card to your new one. This usually happens when you switch from one credit card provider to another, but it is also possible to transfer a balance from one card to another card issued by the same credit card provider. However, consumers should be aware that this type of transfer is usually treated the same way as a cash advance. This means that interest begins to be charged from the date you make a transaction. In many cases, when the balance transfer is related to a new account, the issuer of the new credit card may offer a reduced interest rate for a specific period of time.

Fees that come with balance transfer

These are some fees with a balance transfer.

For example, MBNA charges 1% of the amount you're going to transfer. Let's say your amount is going to be $5,000. You will be charged ($5,000 x 1% = $50) fee for this transaction.

If you're not planning to pay off the debt for 6 months, then the fee will be too expensive. You have to add the amount fee with the total interest cost of the credit card balance with Balance Transfer Credit Card Canada

Balance transfer fees are hard to check when doing a credit card balance transfer. It depends on the card issuer how much fee they will charge to the client which can easily offset the interest. The majority of balance transfer transactions these days will charge a percentage on the amount involved in the balance transfer, with a minimum and maximum amount.

For example:

A card company offers 3% balance transfer fee made to the other credit card. There is a minimum fee limit of $5 and a maximum fee limit of $55. If the client will make a balance transfer of $2,000, the charge is $60. If the client likes to transfer $5000, the charge will be $55 (since 3% of $5,000 is $90, which is over the maximum balance transfer fee range which $5 to $55).

The card issuers are removing their maximum charge fee limit. This mean that with the $5000 balance transfer in the example above, it would cost the card holder $150 instead of the $60 which is the fixed maximum limit. Clients must be aware of the percentage imposed on the balance transfer fee.

Card user will save a good amount of money when a client transfers from a high interest rate credit card to another credit card with a lower rate, the client must also choose credit cards with longer grace period, such as the list in balance transfer credit card Canada. Another tip would be choosing the credit cards with low balance transfer fees. It is advisable to compare balance transfer credit card Canada before applying.

SEE ALSO

Best Balance Transfer Credit Cards in Canada

Choosing the Right Credit Card

Intro to Balance Transfers Cards

References

WiseGeek - What is a Credit Card Balance Transfer?

FCAC - What is a Balance Transfer

FCAC - Getting the Most from Low Introductory Rates

External Links

MBNA Canada Credit Cards

Credit Card Processing

Canadian Credit Cards

BALANCE TRANSFER CREDIT CARDS CANADA

Comments (30)

CMA Blog Home

Best Capital One Credit Cards Canada

There are at least 11 Capital One credit cards Canada available that offer the best service. Each of the cards are easy to determine. All have different benefits that best suit every individual's needs.

The main categories are individuals with Good Credit, Bad Credit, Carry a Balance and Doesn't Carry a Balance. The more you spend using your credit card coupled with your ability to pay off those loans determine your credit standing.

-->

Good Credit - Excellent Credit

Capital One has seven "Good Credit" credit cards. These type of credit cards offer the following features: Travel Rewards, Cash Back, Other Rewards, Low Interest and Balance Transfers. The best Capital One credit cards Canada depends on your needs and your usage.

-->

If you have balance in your credit card, then you are a credit user. You are spending your credit card's available credit line assigned to you and you like the lowest interest rates available. Capital One's best rates are for those who have good credit. There are two cards under this category:

-->

This card is for individuals who have excellent credit history.

The interest rate for this card is 5.99% which is good if you want to save money on interest.. This card requires you to have an excellent credit rating.

Some of the other features are as follows:

- Enjoy a low, long-term rate of 5.99% on purchases and balance transfers, guaranteed for 3 years (as long as you pay your bills on time)

- After 3 years your rate will stay low and become a variable rate of Prime +6.99% on purchases and balance transfers

- Annual interest rate for cash advances is 19.8%

- No annual fee

Other features include:

- Save money when you transfer high-interest debt with our no-fee balance transfer service

- Valuable Platinum benefits, including Purchase Assurance and Extended Warranty

- Add an authorized user for $0

- Add rewards for $99

- MasterCard PayPass

Capital One - Delta SkyMiles® Gold MasterCard®

If your credit history is good, but not absolutely perfect, this is the best Capital One credit cards Canada for you. It has the same features as the Smartlineâ„¢ but with just a little higher interest rate.

Its distinct benefits are:

- Earn Delta miles on everything you buy with no annual fee!

- Get 2,500 bonus Delta miles on your first purchase made within the first three months of account enrolment

- Earn 2 Delta miles for every $1 you spend on Delta purchases

- Earn 1 Delta mile for every $1 on all other net purchases

- Annual interest rate of 19.8%

- Valuable Gold benefits, including Purchase Assurance and Extended Warranty

- Add an authorized user for $0

- MasterCard PayPass

It's best to use this card until your credit rating becomes excellent, and then you can switch to SmartLineâ„¢' Platinum Card.

-->

Doesn't Carry a Balance - Rewards Cards

You are convenience user if you can settle your credit card's balance every month. If you're paying your balance then you should be getting more value on your credit card usage by collecting rewards points of your choice.

SEE ALSO

Carry A Balance Cards

Canadian Credit Cards

Capital One Rewards Credit Cards

REFERENCES

What is an Annual Fee?

FCAC - Best Credit Cards in Canada

Your First Credit Card - Ontario Gov't

EXTERNAL LINKS

Capital One Card Website

Canadian Credit Cards - Gas Cards

Canadian Credit Cards

BEST CAPITAL ONE CREDIT CARDS CANADA

Comments (24)

CMA Blog Home

Best MBNA Credit Cards Canada

MBNA Corporation is the parent company of MBNA America Bank, N.A., which is the United States division of MBNA Corporation, where initially, MBNA means Maryland Bank, N.A.

MBNA offers a variety of credit card that comprises business cards, reward credit cards and cards that allows you to transfer existing balances. Each of these cards is in link with an online account access which is protected by the customer’s security login. MBNA have created programs that would allow their customers to redeem rewards as their card holders use their cards. Rewards come in different offers such as flight tickets, hotel reservations, merchandise shopping and gift certificates. Another interesting offer that MBNA have made is giving 0% interest on balance transfers for a certain period of time and also 0% interest on your daily purchases. However, this 0% interest offer does not apply to all MNBA credit cards.

Now, let’s take a look to the credit cards that MBNA Canada offers.

Good Credit – Excellent Credit

MBNA credit cards are categorized into different areas depending on the credit card applicant’s choice and need. It also depends on the way the customer is going to use your credit card. The areas that are offered by the company are the following: Travel rewards, Automotive rewards, Specialty rewards and MBNA rewards.

CARRY A BALANCE - LOW INTEREST RATES

We might have to use our credit card in all our transactions, right? May it be expenses in our groceries, gas, healthcare and all of those we have to spend on, some of us use our credit cards in those dealings. For the person who is a big spender and spends a lot, then the GOLD MBNA Credit Card is perfect for you. Credit card issuers show the gold credit card as one of the best mbna credit cards canada that a client can have. It creates a status symbol that tells something about you, who in reality says that, what you are earning either on your job, your business or the endeavor you are in makes you earn more than the national average wage. Issuers consider you as better compared to the average credit risk.

A gold credit card have great features compared to those ordinary one since it has a higher credit limit and allows you to draw more cash out on a daily basis. With your gold credit card, rewards are easier to redeem since point you accumulate usually doubles depending of the policy of the reward programs. But definitely, you have the edge compared to those ordinary cards especially with the promos where insurances are given free but requires you to pay annual fee.

The MBNA Gold Credit Card

This best mbna credit cards canada has a credit line of up to $50,000 with supreme 24/7 customer service that allow you to ask, inquire or just simply needing a help with the company. Annual fee are waived for this type of card compared to those ordinary credit cards. In time of cash access is utilized, you can avail it at 430,000 ABMs worldwide which means it’s very convenient for the user. Regarding with purchase assurance and other valuable, there is no risk and difficulty as it offers almost everything.

What comprises this credit card:

• Annual interest rates:

o Purchases: 9.99%.

Balance transfers (including cheque cash advances): 9.99%.

Cash advances (including cash equivalents): 9.99%.

• Interest-free grace period: 21 days.

• Account fees:

o Over the credit limit: $35.00 per billing cycle

o Returned payment: $20.00 per occurrence

o Returned cheque cash advance: $20.00 per occurrence

o Extra copy of monthly statement or sales draft: $2.50

o Inactive credit balance: If your account is inactive and has a credit balance, we will charge you annually the lesser of: (1) the credit balance; or (2) $25

• Transaction fees:

o Cash advance (including automated teller machine and over the counter advances): 1% of amount advanced (minimum fee of $7.50)

o Balance transfer (including cheque cash advances): 1% of amount transferred or advanced (minimum fee of $7.50)

o Cash equivalents: 1% of amount purchased (minimum fee of $7.50)

o Wire transfer: 1% of wire purchase amount (minimum fee of $7.50)

The MBNA Platinum Plus credit card

This credit card has a generous amount of credit limit reaching $100,000. It comes along with a no annual fee charge and has a round-the-clock customer service access. Concerning with security, the card has a fraud protection that is online 24/7 which mean you wealth is very much secure. An online access of your account is available where you can see how you have used your card and what purchases or transactions you have deal with. 1.99% introductory annual interest rate on Cheque Cash Advances and Balance Transfers for 10 months is charged by the company. What is more amazing with this best mbna credit cards canada is that it is internationally accepted to millions of location around the world which mean less hassle but great value.

What comprises this credit card:

• Annual interest rates:

o Purchases: 17.99%.

Balance transfers (including cheque cash advances): 19.99%.

Cash advances (including cash equivalents): 19.99%.

• Interest-free grace period: 21 days.

• Account fees:

o Over the credit limit: $35.00 per billing cycle

o Returned payment: $20.00 per occurrence

o Returned cheque cash advance: $20.00 per occurrence

o Extra copy of monthly statement or sales draft: $2.50

o Inactive credit balance: If your account is inactive and has a credit balance, we will charge you annually the lesser of: (1) the credit balance; or (2) $25

• Transaction fees:

o Cash advance (including automated teller machine and over the counter advances): 1% of amount advanced (minimum fee of $7.50)

o Balance transfer (including cheque cash advances): 1% of amount transferred or advanced (minimum fee of $7.50)

o Cash equivalents: 1% of amount purchased (minimum fee of $7.50)

o Wire transfer: 1% of wire purchase amount (minimum fee of $7.50)

DOESN'T CARRY A BALANCE - REWARDS CARDS

Card users that use their credit cards for convenience usually settle the payment of their cards every end of a month. Once they have paid their credit balance, they are able to receive a lot of rewards compared on the amount of usage they have made with their cards. They are keeping on collecting points and redeem rewards as much as they want. But this usually depends on the amount of accumulated points the card users have gained and collected.

When spending much with you rewards card, it then comes with an annual fee depending on the company. Sometimes companies waived these annual fees but this is done when the card holder pays off the balance regularly every end of the month or when you are able to reach your credit limit with you purchases. You must be aware of the cards that offer less annual fees or no annual fees at all.

We break these categories out by if the individual spends a lot each month using their cards, or a little. (Generally the marker is around $2500 per month.) If you spend less than $2500 then you would consider a different card than if you spend more than $2500 per month.

Spend More Than $2500 / Month - Rewards Cards

In this category, card users are those who spend more than $2500 per month or more than in using their credit card. This means that when you receive your billing statement, they have reached more than $2500 with your balance. This credit card then fits these types of clients. Clients would surely settle their annual fees to prevent penalties but as well gain rewards points from using the card in their transactions.

MBNA PremierRewards® Platinum Plus® MasterCard®

A rewards credit card that pays you back with what you have spent for. It allows its customer to make their dollar spent to go as far as possible. This means that this company allows their card holders to enjoy the rewards they have prepared especially to those clients who spent much using their card and accumulate numerous points. It could be then exchange with surprisingly great items or merchandise. It can even become certificate for groceries, gas or for shopping.Check on the features of this rewards credit card and compare to which features and offers you are fascinated on.

Here are its features:

• As commonly offered by rewards credit card. This card has No Annual Fee as well.

• 1% back on all net retail purchases when buying merchandise or any transactions that you have used your rewards card.

• There is a yearly automatic rewards crediting in your account once you have availed with their promos especially those that are offered in the company’s website.

• Regarding with points, there is an enticing policy of No spending limits or earning limits. Customers can earn points as much as they can and redeem rewards equivalent to their accumulated points.

• There is Exclusive platinum benefits and peace of mind for the card holder that provides less risks and hassle.

• Booming credit limit of up to 100,000 is offered by the card issuer giving the customer a wider range to spend on their credits.

• Customer service is always present 24/7 for any inquiries or problems that these card holders may encounter when using their credit cards.

MBNA TravelRewards Platinum MasterCard

With MBNA TravelRewards credit card, everything you want and nothing you don’t. This is how this card works. It allows its client to enjoy everything they offer. In their rewards program, points are earned in every dollar spent in net retail prices. This is just one of the features of MBNA TravelRewards Platinum MasterCard.

Try to check and evaluate the number of feature the card consist of:

• When purchasing, the amount of dollar you spent will also be the number of point you get. In other words, $1 is equals to I TravelRewards point.

• When having your first qualifying transaction, 5,000 TravelRewards point will be instantly given on your account.

• Anniversary date is always celebrated yearly and its client gets to enjoy a gift of 2,500 bonus points.

• Choose from the 75 airlines to which you prefer to use your travel rewards as exchange of your TravelRewards points. No blackouts.

• Enchant yourself with the Platinum card benefits that the company offers.

• Competitive annual fee of $89 charged but could be waived for being a good credit payer on your balances.

• Credit limit reaches up to $100,000 as an allowable credit to be spent and used by the card users.

• Fraud protection is present at all times making less hassles and burden on the customers.

• 24/7 customer service offered through online by logging in to your secure account.

• Stolen, lost or damage cards are quickly replaced in just a 48 hour waiting period. Additional cards are allowed and offered by the company for the convenience of the clients.

• Immediate cash access of $430,000 ABMs worldwide for this card and is widely recognized and accepted on more than millions of location around the globe.

Spend Less Than $2500 / Month - Rewards Cards

Card holders that belong to this category are those clients that spend less than $2500 per month in using their credit cards. This card holder keeps a good budget with their finances as they would go for the things that are necessary for them.They are taking advantage of the feature promos that each specific cards can offer them.

MBNA WorldPoints Rewards MasterCard

This best mbna credit cards canada has been the most rewarding MasterCard as it gives you instant 1.000 world points as an introductory reward. With that, you can avail right away of its offered rewards even without using or earning points yet with your card. You have just simply got a card and receive a reward in return.This rewards credit card has a lot of features to get to know too.

Here is the list of its card features:

• You easily Earn 1 world point for every dollar you have spent.

• With your first qualifying transaction, you can instantly earn 1,000 bonus WorldPoints.

• Once you reach a certain number of point, you can redeem WorldPoints rewards either of your choice whether spend it for travel or for merchandise or both at the same time.

• Redemption level is at 1,000 WorldPoints which mean that the moment you got the card with the instant 1,000 WorldPoints, you can avail a certain reward equivalent of the points you have

• Annual fee is cheap compared to other rewards cards which are only at $29.

Bad Credit – Other Banks Credit Card

Credit cards that are presented here are those card holders who don’t have enough credit history as well as credit rating. Clients who are first time user of credit cards also would belong here. Credit cards offered in this portion are categorized into three. The categories go as follows: Secured credit cards, Carry a Balance and Don’t Carry a Balance. Check out each category and also each credit cards provide in order to know what is the best card that fits you.

SECURED CREDIT CARDS – LOW INTEREST CARDS

Clients do have past history with their past use of credit cards. Sometimes, these clients can’t avoid of having bad credit history which could affect also the credit rating. Some are don’t have any credit history yet as they are first timers in applying a credit card. These credit cards are the key in getting a good start of building an excellent credit history again. These cards also offer less interest which means less risk for the client to be troubled in paying their balances. Compared the card benefits and pick the card that gives you much advantage.

Capital One Low Rate Guaranteed Secured MasterCard®

Capital One offers this card to clients who don’t have any credit or limited credit history. This is a card that allows customers to start building their credit history. One of the perks of this card is that a guaranteed approval of having the card. Another is the low interest rate it offers as well as low annual fees.

This credit card comprises these following features:

• Any application of the card has a guaranteed approval.

• Master RoadAssist™, MasterCard Global Service™ and MasterCard PayPass™ are use in tap-and-go pay system that gives less hassle for the client in payment as the card don’t need to be swiped.

• Low Interest rate of 14.9% on purchases and balance transfer that does not bring trouble to client during payment of balances.

• The customer service is on standby 24/7 through phone or online.

• 0$ fraud liability for any unauthorized purchases.

• Give you the chance in building a credit history.

Citi® Secured MasterCard®

This credit card helps client rebuild their credit history to be able to apply soon to conventional credit cards. The bank would require depositing an amount that would range from $200 to $5, 000 into a certificate of deposit. This would then become the credit limit of the credit card.

Here are the features of the credit card:

• Having the card you may become eligible for an unsecured card after 18 months of card usage.

• $0 liability on unauthorized charges made into the client account.

• Citi® Identity Theft Solutions protects the account and personal information of the card holder.

• No required income or co-signer to start building a record of account performance.

• With retail purchase protection, the items purchased with your card are safe against accidental damage or theft for up to 90 days from the day the product is bought.

• Tap-and-go system of Citi MasterCard® Payment Tag with PayPassTM is a new innovation where you just tap your card rather than the old system of swiping it.

• Citi® Credit Card Benefits & Services offers cash or rewards such as American Airlines® awards and travel benefits to cash back and college saving.

Orchard Bank Secured MasterCard®

Client who undergoes bankruptcy would have a hard time qualifying for a conventional credit card because of its qualification like having a good credit history. This card offers best value for customers who need to restore their credit history after undergoing serious credit setback. The company gives much benefit to their card holders. Check the list of feature and benefits the card offers.

List of Orchard Bank Secured MasterCard benefits:

• No annual fee charges on the 1st year of card usage. Succeeding years would have fees but can be waived based on credit performance.

• No account processing fee for any transactions made.

• Low interest rate for the client enjoyment of card usage.

• A credit report is transmitted to 3 major credit bureaus that evaluate and updates the client’s credit history.

• Credit limit is based on the account deposit funds. It start at $200 account balance.

CARRY A BALANCE – WITH MAXIMUM BENEFITS

Credit user is entitled to carry a balance on their credit cards. The cards can be used to the extent of how much credit line is available for the card holder to spend. Low rate are available and is risk-free in getting into trouble of too much debt acquired. This card are for client who has bad or fair credit as well as new credit card holder who has none or limited credit. In addition, client who has bad credit history belongs in this category.

Capital One Guaranteed MasterCard®

-->

This card allows the card users to experience all the benefits of having a credit card. Capital One gives the client the luxury to be able to rent a car, do shopping online or book hotel rooms. With this Capital One credit card in your hands, your credit history will not suffer but instead build up as long as you pay your bills on time. This card has a lot more to offer. Check it out below.

Other Capital One Guaranteed MasterCard benefits:

• Travel benefits offered: Master RoadAssistTM, MasterCard Global ServiceTM, MasterAssistTM Travel Assistance Service for client safety all the time.

• Travel accident insurance is also given aside from the safety assistance.

• MasterCard PayPass™ give convenience in paying bill for the card holder.

• Tap-to-Go system when using the card to have less hassle from card swiping.

• 27/7 standby customer service to phone or online.

• $0 fraud liability for unauthorized card use.

• The Guaranteed MasterCard® additionally protects you with purchase assurance and extended warranty for the time the client is still rebuilding the credit history.

DON’T CARRY A BALANCE – REWARDS CARD

Card holders under this category are considered convenience users as they used the card credit and pay them off each month when their billing statement is received. They spend less but get as many rewards points. The acquired points can then be redeeming with rewards. In addition, cash backs are given in certain percentage of the purchases made.

Capital One Cash Back Guaranteed MasterCard® for Gas Groceries

For client who is seeking for a rewards card and at the same time building an excellent credit history, Capital One Cash Back Guaranteed MasterCard is the right credit card for you. This card would let you gain points to redeem specific equivalent rewards. It also provides cash back on the total purchases made using the card. Receiving cash back don’t have any limit as long as the account exists.

More credit cards benefits listed below:

• 2% cash back on gas payment are returned to the client and also with the groceries purchases.

• Additional 1% cash back on all other purchase with the card.

• $0 fraud liability on unauthorized use of the credit card.

• Client can reach the 24/7 customer service through phone or online.

• In redeeming rewards customer is given an option to choose if the cash back will be via statement or cheque.

• Annual fees are reasonably fair as the company allows additional authorized user to every account.

Having read and learned for the different credit cards that belong to a specific category. It is your time to think and choose what credit card suits your lifestyle and your needs. Be wise to compare their benefits as each card are considered unique. Weigh out which benefit are you interested on and would give you much savings. Apply then and enjoy the freedom of spending!

SEE ALSO

Carry A Balance Cards

Best Capital One Credit Cards Canada

Best Secured Credit Cards Canada

References

What is an Annual Percentage Rate

Annual Percentage Rate

Travel Insurance Policies

External Links

HomeTrust - Secured Visa

Get A Good Credit

Get an Excellent Credit Score

MBNA Credit Cards

Credit Card Reviews

BEST MBNA CREDIT CARDS CANADA

Comments (14)

CMA Blog Home

Best Mastercard Credit Cards Canada

MasterCard credit cards are considered one of the most accepted and most reliable source of credits that a card can have.

These cards are issued by banks, financial institutions, different stores, shops and a variety of retail outlets. Before getting a credit card, you must first know how the card works and what features the banks or companies offer. Learn and remember the fees it requires to card holders before availing their services.

Before signing up for a credit card and start using it, you must know the difference between a credit card and a charge card. Here are some pointers before deciding what card you're going to get.

Charge Cards are usually used for gas, groceries and shopping. These cards are offered by some companies. Compared to the other type of card, the card user must be responsible to settle all the remaining balance every end of the month or before its due date. Otherwise, the card holder will be penalized with multiple penalties.

Credit cards are more tolerant to their clients. They tolerate card holder to carry a balance in their card on monthly basis. But still, the company prefers on-time payments of the full balance every time the client receives a billing statement. Penalties are not strictly imposed as the bank or financial institution would give extensions to customer to settle their accounts.

Credit cards have different categories. The Best Mastercard Credit Cards Canada requires: Good or Excellent Credit, Carry a Balance, Does not Carry a Balance and Bad Credit. There are two sub categories under the Doesn't Carry a Balance.

Good Credit-Excellent Credit

MasterCards have different companies offering credit cards. They come from banks and financial institutions all over the world. The difference of these credit cards depend on benefits and promos that the card holder can avail. These cards also differ in the Annual and Interest fees that are being charged by the card issuer. They also have different penalty charges to clients who are not settling their accounts on time.

SEE ALSO

Carry A Balance Cards

Best Capital One Credit Cards Canada

Best Secured Credit Cards Canada

References

What is an Annual Percentage Rate?

Annual Percentage Rates

Credit Card Travel Insurance Policies

External Links

HomeTrust - Secured Visa

Carry A Balance To Get Good Credit

Get A Credit Score

MBNA Credit Cards

ReviewCentre - Credit Cards Reviews

BEST MASTERCARD CREDIT CARDS CANADA

Comments (24)

CMA Blog Home

Visa Rewards Credit Cards Canada

Are you interested in Visa Rewards Credit cards in Canada? This article has alot of good and specific information on this topic.. Have more questions? Please join in the conversation on the blog comment section below.... CCHelper can help answer your questions.

Specific Rewards Program in Canada

AeroPlan Rewards

An Aeroplan reward is the most famous reward program in Canada. It is a Canadian-based frequent flyer marketing program where points are being given and can be accumulated to reach a certain reward that the features and promos offer. A lot of rewards can be redeemed via the Aeroplan web site in which rewards are lined up with all the affiliated companies of Aeroplan. With your points gathered, rewards come in different choices depending on your desire. It can be an airline ticket, hotel reservations, vacation packages, car rentals or merchandise.

TD Visa Travel Rewards

The TD Visa Travel Rewards program is offered by TD Canada Trust. In earning TD points, you can gain 2 to 3 TD points for every dollar you spend using the TD Travel Visa card. Accumulated points starting at 10,000 with no blackouts or restrictions allow you to redeem travel rewards. Earning bonus rewards on top of what the company has entitled the customer is possible when you purchase travels through the TD Travel Rewards Center

RBC Rewards

RBC Rewards is a banking company that allows their customers to earn points that can be converted to amazing rewards. Points saved can redeem for your travel, merchandise, registered investments and gift certificates as what the company entails their card users. RBC rewards have several partners which give additional rewards on top of those already provided with the card. Points can be redeemed via their online web site or by phone, fax or mail depending on what is convenient on you.

Adventura Rewards

CIBC through their Adventura Rewards is offering their clients’ lifestyle rewards program where points are accumulated and can be redeemed for flights, hotels, rental cards, vacation packages, gift cards and lifestyle rewards. Earning 1000 Adventura point bonus is given as additional credits with what you regularly earn when you register at their web site to use your Adventura points to redeem what is served on their list of promos. Visa Rewards {{{credit card}}} Canada

BA Miles Rewards

BA Miles allows only the members of the British Airways' Executive Club to avail in their reward program. Only a single card is designed and offered by BA Miles, the British Airways Platinum Visa credit card which is responsible for earning points for every credit transactions. You can earn 1 BA Mile for every dollar spent with card. Special package offers are made for every time a card holder purchases a qualifying round-trip with non-restricted full fare ticket from Canada to anywhere British Airways flies entitles the holder to get a companion trip for free. When you become part of the BA reward program, instantly you will earn 10,000 bonus BA miles and additional 2,500 BA miles every company anniversary. Doubling your BA miles is easy earned with every dollar spent on British Airways.

Scotia Rewards

The site of Scotia Rewards VISA, a credit card that offers you points with each purchase to exchange for benefits. Using Scotia Rewards allows you to choose what travel booking you want, either on air by grabbing a flight or by a train ride. Other rewards offered are hotel reservations, holiday packages and cruises. Visa Rewards Credit Cards Canada. Getting travel tickets can be done any time with special remarks of no restrictions, limited seating, blackout periods, or Saturday stay requirements. Point may also be redeemed with merchandises or other rewards available on their featured and promo options. In addition, Scotia Rewards uniquely gives you a chance to exchange your points with gold bars as well as other precious metals the company is offering.

AAdvantage Rewards

AAdvantage is a frequent flyer rewards program offered by American Airlines. Aadvantage awards can be redeemed for flights on American Airlines or partner airlines. Aadvantage credit cards earn 1 AAdvantage mile for every dollar spent and earn double rewards when purchasing flights on American Airlines.

Esso Extra Rewards

Esso Extra point can be earned through purchasing their services. Point can then be redeemed through their stations where they offer car washes, car supplies and free gas through their participating outlets. Spending a dollar at Esso Extra stations would guarantee you a point. You can avail their promo of doubling your points when buying merchandise at Esso stations.

Scene Rewards

In cooperation with Cineplex and Scotiabank, a movie rewards program is made called Scene. With your Scene credit card, you can earn 5 times the point when buying products. Earn 1 point for every purchase for non cardholder at Cineplex Entertainment. Movie passes and music downloads can be redeemed as rewards using Scene points. Visa Rewards Credit Cards Canada

Cathay Pacific Airways Rewards

Cathay Pacific Airways along with some other participating Airlines give their customer rewards for having them the airline of choice. They offer client to travel to over 900 destinations worldwide as a reward program. In addition, hotel bookings, gift cards and merchandise are also offered through their website.

Save-On-More Rewards

Save-On-More rewards program let its customers earn 3 point for every dollar spent using Save-On-More Visa card on the following participating Food shops/stores: Save-On-Foods, Overwaitea Foods, Cooper’s Foods, PriceSmart Foods and Urban Fare stores. Visa Rewards Credit Cards Canada. With your Visa, earn 2 point per dollar spent on merchandise. A lot of rewards with equivalent amount of point await its customers like gift cards, travel, electronics and more.

Duetto Dollars Rewards

Duetto Dollars by Starbucks created a rewards program which gives their coffee-lover customers a chance to gain 1% Duetto Dollars for every purchase. It can be used to grab some coffee e and merchandise for free. The Duetto credit card acts as both a Visa and a reloadable Starbucks card. When loading a Starbucks card, instant 3% Duetto Dollars will be given back. Visa Rewards Credit Cards Canada

Marriott Rewards

Redemption for flights, cruises, and merchandise including electronics through Marriott Rewards program is hassle free and easy. 3 points earn per dollar spent at Marriott locations and 1 point per dollar everywhere else.

Visa Rewards Plus

Citizens Bank of Canada along with VanCity created a reward program. It is called the My Visa Rewards Plus which entitles you to gain and collect points. These points would then be convertible to reward items such as for airfare, buying merchandise and financial products. Furthermore, it made something special in which you can help your community with your accumulated points by donating it to any of your chosen charitable institution or to sponsor a generous cause. Booking a ticket would start when you reach the 5,000 points and gives you no blackouts or Saturday stay requirements.

BONUSDOLLARS Rewards

Desjardin’s sponsored reward program has been used by Coast Capital Savings to give their customers rewards in return for their loyalty and their patronage of the service. BONUSDOLLARS is the reward program that allows client to redeem offered rewards either to avail unrestricted travel, show flight tickets, gift certificates and even financial merchandises. By simply using the BONUSDOLLARS credit card in paying for a trip or purchase a product, you are now capable of getting point to receive or collect available rewards offered by the companies.

Annual Credit Card Fees

It is a fee that is charged on an annual or yearly basis to the visa credit card holder for simply having their credit card. The fee may range from $0 which means that the credit card companies have free annual fees on their visa credit cards to a maximum of $100 depending on what card company and the type of features the card comprises. Visa Rewards Credit Cards Canada. Usually credit card companies waived the first year annual fee to their card holders as a reward for having chosen their service but this doesn’t apply to all visa credit card companies. The amount on annual fee that each credit card holder is charged for doesn’t reflect how much amount or value of purchases there is with the credit card.

Some companies waived their annual fees on your second year and the subsequent years as a card holder when you, as a client, are a good credit payer which means paying the billed amount on or before the due date. Another feature would be when you reach your given credit limit in a month time and settling it before the due date elapsed, it will also entitle you to expand your credit limit aside from the free annual fee.

Freebies and rewards are also given to how you use your visa credit card and to what merchandise you have purchased with your card. In some instances, the credit card companies tie up with other establishments. In this case for example, when one reaches a certain credit amount, he/she is entitled to claim a freebie or reward from the collaborated establishment. Some companies would entitle their customers to earn points and these points will be equivalent to specific rewards.

For example, Cash Back Plus Platinum MasterCard® with No Hassle Rewards has an annual fee of $99 compared to Gold MasterCard® credit card that doesn’t have any annual fee but may have higher annual interest rates. It really depends on the amount of annual fee and the annual interest and well as the credit limit of the credit card.

Credit Card Interest Rates

Interest rate is a certain rate in which the visa credit card issuer generates revenue. A card issuer is the one that provides a consumer a card that comes along with a credit that can be used to purchase and make payments or borrow money from a bank or company. The bank or card issuer pays the clients charges which would be subject for interest charges over a period of time the money was borrowed. A risk on the part of the bank or company is taken as the cardholder may not pay the amount money borrowed as agreed. As a result, interest rates are charged as exchange of the credit risk incurred by the card issuer and become the issuer’s profit. Visa Rewards Credit Cards Canada. Bank or company that provides visa credit cards does investigations on credit card applicants to check whether they are capable of paying what is due on their billing statements. Assets, bank accounts, work stability and other finances of the applicant are the aspects to be checked on by the card issuer. In case a deficit is seen during the investigations, visa rewards credit card issuers may not approve the application. Visa Rewards Credit Cards Canada

Interest rates differ in every bank or company. The higher the credit limit and the allowable time to settle the borrowed money, the higher the interest rates charged. Usually interest rates ranges from 10% to 20% on cash advance while 5% to 15% on balance transfer. Purchase interest rate ranges from 5% to 15% which more or less of the same when doing balance transfer. The creditor who is much more stable on their finances can take risks in lending credit or money in a lesser interest compared to others. Some may consider the financial stability of the card user or on how they settle their loan money.

For example, let's say you have a visa credit card with a $500 credit limit that has an Annual Interest Rate (AIR), of 9.99% and an annual fee of $50. If you used the entire credit limit for one year, you'd pay 10% just for the annual fee, since $50 is 10% of $500. Then when you add that to your AIR, you'll find the true cost of that $500 is at 19.99%. If that same card had a $20,000 credit limit, and you use the entire limit for one year, the cost of your annual fee is only 0.25%. That makes the total cost for the $20,000 at 10.24%, which is quite satisfactory in their charges.

Credit Card Penalties

Penalty rates are charges that are imposed by a visa credit card issuer to penalize the cardholder. There are 3 charges that are usually given. First is when the creditor did not settle his accounts on time. Second is when the creditor exceeds beyond the credit limit that the card issuer has provided and third is when the card user issued a bouncing check in paying the amount of credit used. Companies are strict with due dates and they consider late as a demeanor for the creditor. Some companies permit a number of late payments which is usually two late payments. However, once it reaches its triggering status, high amount of penalty rates are imposed. Exceeding credit limit would be noticed when charges bounce the moment the creditor reach their credit limit. Usually, the companies would allow going beyond the credit limit but it would also entail over limit fees and penalty rates.

Example of this would be when you have purchased a merchandise worth $10,000 and your limit is just $7000, then you are $3000 above you limit. This means you’ve passed balance that the company has granted you. Almost all of the visa credit card companies penalize a client who does bouncing payments due to inefficient funds or lack of money in their saving accounts. Checks that bounce upon its clearing with the bank are given charges. Usually these charges are easily added with the due payments of the customers. Fees may range from $80 to $150 depending on the company and the amount of debt the creditor has.

With these penalty rates, the visa credit card holder payments or loan would shoot up leaving the creditor more debt to pay for. Commonly, penalties rate plays around 20% to 30% depending of the amount or loan the card holder is liable. Most of the bank or company put high penalty rates in order that clients would not fall into the pit of triggering the rates. Charges would be consistently be added to the amount borrowed until such time that the card holder pays more than what is asked during monthly billing statements.

What makes these cards different from MasterCard, American Express?

Canadian visa credit cards are offered by many banks and other companies. They come in different features depending on the company may it be with the annual fees or interest fees. For example, Capital One is a banking institution that issues credit card to their applicants. They give fair charges to their client close to other banks’ card charges. They allow and approve those customers who wish to avail their card service taking consideration of the holders’ history and financial stability. Annual Fees and Interest rate are of the same rate and range with other visa credit card issuing banks. Visa Rewards Credit Cards Canada. However, they mostly differ in how they offer rewards to their loyal and good paying creditors. They are tying up with other companies to provide promos and featured rewards which then are available for their customers to avail.

On the other hand, MasterCard is not a company that actually offers customers credit cards. They are not also responsible for lending money or provide loans to their clients. They are payments networks that use computer systems that allow processing of credit card transactions. The credit that the credit card carries comes from a certain bank, credit union or other financial institutions. Specific terms or policies of the card are set by the card issuers which are the interest rates that come in different rate depending on the client preferred company. A client can have two MasterCards with different issuers with different card terms on the interest fees. The card issuers take all the risk and burden if these clients fail to pay their card bills. With American Express, it has a different way of dealing with their clients. It has been tagged as “exclusive” which means that this company selects their lenders rather than issuing everyone that applies for their service. They have been giving cards and charged their card holders with high annual fees as well as with the interest they place on their client’s accounts that has to be paid in full every month. As the company continuously offers their service, they have begun to negotiate with other issuing banks to become their partners. Now, they issue credit cards that carry a balance along with charge cards. Visa Rewards Credit Cards Canada

See Also

Best Credit Cards Canada

Best Balance Transfer Credit Cards Canada

Best Cash Back Credit Cards Canada

Best Capital One Credit Cards Canada

Best MasterCard Credit Cards Canada

Best MBNA Credit Cards Canada

Best Visa Credit Cards Canada

Best Secured Credit Cards Canada

Travel Credit Cards Canada

References:

Credit Card Penalty Rates

Credit Cards Offers

Knowing the Banks

Visa Credit Cards

Credit Cards Canada

Reward Programs Canada

External Links:

Aeroplan Points Program

TD Travel Rewards Credit Cards

CIBC Aero Classic

British Airways Travel

Scotiabank.Rewards

RCB Royal Bank Credit Cards

VISA REWARDS CREDIT CARDS CANADA

Comments (21)

CMA Blog Home

Best Visa Credit Card Canada

Visa credit cards are offered by many banks and financial institutions. These cards are offered to a client who doesn’t want to bring cash with them but instead, use the credit that their cards contain in their transaction. These transactions can include either purchasing, getting an airplane ticket or simply for shopping purpose. These cards are categorized based on the features that are bound to it. The categories are as follows: Carry a Balance, Doesn’t Carry a Balance and Excellent to Good or Bad credit. Also, there is an additional category for the clients who spend much with their card and those who spend less but enjoy the benefits that their card offers.

Compare each cards specified below in order to learn what card suits your preference especially on how you care for your finances. And hopefully, you will be able to decide which card to apply for that caters what you need and apparently, enjoy its benefits and privileges.

Good Credit - Excellent Credit

The cards that are offered in this category are for those individuals who have good or excellent credit history. They are entitled to avail for the exclusive benefits that the bank or card company offers. Cards found in this portion have features like low interest rates, cash back guarantees, travel rewards and other amazing rewards. With how you handle your spending habit, you can surely pick one of the cards.

CARRY A BALANCE – REASONABLE INTEREST RATE CREDIT CARDS

In this category, when you receive the credit card you have applied for, it is carrying a balance with it where you can use it to do a transaction with business. You can use it for purchasing goods, items or in any way you prefer, as long as you use what is available credit limit the card has been entitled to. Best Visa Credit Card Canada. with this card is the interest rate which you are responsible to settle when the payment time comes.

CIBC Platinum Visa™ Card

When you are looking for a Visa credit card with extended purchasing power and premium benefit, CIBC Platinum Visa is the perfect card for you. It doesn’t have any annual fee even if the company gave you the best feature it can offer. Having an excellent credit history that you have build would be a great advantage when you apply for this card. More benefits are entailed this card that surely, you would take pleasure in.

Check the added benefits of this card:

• The credit card gives you a high credit limit of up to $50,000 for you to spend with your needs and desires. Credit limit starts at $5000.

• The card is protected with the automatic replacement repair or reimbursement coverage of the bank if the purchases you’ve made is lost, stolen or damaged within a gracious leeway of 90 days.

• The card is guaranteed of bundle no-fee insurances.

• VISA Auto Rental Collision/Loss-Damage Insurance is provided to the user.

• $500, 000 Common Carrier Accident Insurance is also given.

• Best Visa Credit Card Canada

• No worries of lost purchases as the card have Purchase Security and Extended Protection Insurance.

• Free personalized CIBC Convenience cheques for issuing payment.

• AVIS car rental gives 20% discount on their services at participating locations only.

• Cash advances of up to $1000 a day.

• Even hotel reservations are guaranteed by the card company.

• When card is lost or damaged, it is replaced with their Emergency card replacement program.

• VISA cards are accepted worldwide at over 24 million locations now.

CIBC Select Visa™ Card

This credit card lets their card holder enjoy a low interest rate of 11.5%. The card also offers a very least amount of annual fee which is at $29 only. This requires an excellent credit history which means that elite card users belong to this level. The mention card features are just two of the many benefits that the card offers.

Additional card benefits below:

• It instantly gives the card holder $100,000 Common Carrier Accident Insurance that can be used to give a helping hand to the customer when they unfortunately get into an accident.

• When renting a car, AVIS Car rental give the client a whapping 20% discount to all participating locations only.

• In using a cheque, CIBC is offering free personalized Convenience cheques.

• You can get 3 maximum credit cards per account with no extra charge coming from the card issuer.

DOESN’T CARRY A BALANCE – REWARD CARDS

This category belongs to the credit card user who pays off their balances every end of the month. They settle the amount of credit they have used and at the same time, get as much rewards coming from the points they have earned. Best Visa Credit Card Canada. These points are used to redeem rewards such as merchandise, gift certificates and a lot more.

We break these categories out by the kind of spenders: those individuals who spends a lot each month using their cards, or otherwise. (Generally the marker is around $2500 per month.) If you spend less than $2500 then you would consider a different card than if you spend more than $2500 per month.

Spend More Than $2500 / Month – Rewards Cards

Chase Sapphire Card

This credit card gives much bonus points which gives you the freedom to grab the rewards available using the bonus points earned. Travel, gift cards, merchandise, cash back and more are examples of the rewards it offers. Check the other benefits and compare it with other cards.

Chase Sapphire Card offers the following as additional features:

• Earn $100 in rewards which is equivalent of 10, 000 bonus points to use for redemption of surprises.

• Double points gained on flight tickets booked through Ultimate Rewards and single point for purchase made with the company.

• No points expiration and no limitation of how much point earned.

• Premier travel and purchase protection benefits given to the client.

• Dedicated service advisors are on standby 24/7.

• No annual fee charge even if the card company is giving all the card benefits it can offer.

CIBC Aerogold® Visa™ Card

Travel rewards are the most special feature of this card. It gives a lot of benefits for people who loves to travel for leisure or for business purposes. It also offers points that can be redeemed with equivalent rewards based on your points earned. The exclusive benefits are listed below. Best Visa Credit Card Canada.

List of CIBC Aerogold Visa™ Card benefits

• 15, 000 bonus Aeroplan® Miles on the first purchase of the card which is equivalent to one economy class short-haul flight at the ClassicFlight® reward level.

• Earn 1 Aeroplan Mile every time a dollar is spent by the card user.

• 1.5 Aeroplan Miles awarded for purchasing gas, groceries and items from the drugstores.

• Aeroplan participating partners also give additional points when you use the card at their stores or shops.

• Air Canada and Air Canada Jazz including Executive Class/Executive First 1 are given free access for the card users for the available seat only.

• CIBC guarantees the client that points earned will not be lost even being inactive for 12 months.

Capital One Venture Rewards Credit Card

Looking for a card that doubles your points? Capital One VentureSM offers it. It allows client to gain double miles on every purchase using the card. This is just one of the many fascinating benefits the card offers.

Here are the other features of the card:

• Earn 2 miles per dollar spent on your everyday purchases.

• When you have spent $1,000 in the first 3 months, instant 10, 000 bonus miles is awarded on your account.

• Avail the offer of flying free on any airline, anytime of the year with no blackout dates.

• No foreign transaction fee will be charged.

• Standby customer service is always available to help the clients.

Spend Less Than $2500 / Month – Rewards Cards

Chase Freedom Visa $50 Bonus Cash Back

This credit card gives many rewards to the client starting from the cash back of $50 during the first purchase of the card. It has 0% introductory APR and no annual fee being charged for this Chase Freedom Visa to its user. Check out the additional benefits offered for this card.

Chase Freedom Visa offers you more benefits:

• 5% cash back offers is returned to the card holder when purchasing gas, home improvement and department stores.

• Get additional 20% cash back when buying with the specific merchant online using the Chase credit card.

• 1% cash back for all the credit spent – no spending tiers or caps on how much you can earn.

• $50 bonus cash back during the card first purchase.

• No annual fee as well as introductory APR.

Capital One® No Hassle Miles Rewards

This credit card is for card holders who are frequent flyers but don’t want to spend much. They rely on the rewards they get coming from the points they’ve earned.

Here’s what you get for having this Capital One® No Hassle Miles Rewards credit card:

• 0% introductory APR on purchase until May of next year – 2011.

• No annual fee for this credit card.

• 1.25 miles points awarded for every dollar spent on buying merchandises.

• Earning points doesn’t have limits and expiration.

• Rewards offered to client are travel, merchandise, gift cards and other items.

• Mo blackout dates and no seat restriction policy given by the card company.

• Best Visa Credit Card Canada

• Fly to any destination with the airline of choice.

• No foreign transaction charges.

Bad Credit – Fair Credit

The credit cards that are going to be presented here are for client who needs to build their credit history back after experiencing past failure on handling their credit cards as well as their finances. These cards are categorized in three which are Secured credit cards, Carry a Balance and Don’t Carry a Balance. Any of these three choices may help you rebuild a good or excellent credit history. Furthermore, makes improvement of your credit rating. Try to compare each card and indentify what category you fit and the kind of credit card that compromise your needs.

SECURED CREDIT CARDS – REQUIRES MINIMUM SECURITY BALANCE

Credit cards shown in this category only requires minimum deposit which would then be the source of credit you can use to purchase or have transactions. But definitely you can add more soon when you get the chance of earning more money. The usual requirement of these cards is just putting up a security deposit with a certain amount of money.

Home Trust Secured Visa Card

This card company allows their client to build or rebuild their credit history without putting much financial burden. Cards that are discontinued don’t put the card holder at risk of trouble but only required to pay the outstanding balance as the company has served you. In exchange for the payment is that your security balance will be returned.

All the benefits that the cards offers:

• Minimum balance of $500 is all what the company needs for you to get the credit card.

• Interest rate is at 19.99% for cash advances and purchases.

• Annual fee is charged which is at $49.

• With card approval, everyone is considered prospects.

• Client can either make purchases over the phone or through online.

• Card holders access to their cash are available over 1 million Visa or Plus affiliated ATMs all over the world.

• Over 24 million locations worldwide are provided to the card holders to shop and use their credit card

• Easy to plan and book a vacation when using this Home Trust credit card.

RBC Royal Bank Secured Card

This card basically has of the same feature with other secured credit card. But what makes this card unique is that in a security account, the client is the one who will decide on how much he would deposit to the bank account. Best Visa Credit Card Canada. RBC Royal Bank gives the client the freedom how much to deposit to have the secured card.

Here are the secured card benefits enumerated below:

• A co-applicant is also entitled to get a card under one account.

• Spending limit of the card is based on how much the card holder has deposited in the security account.

• The security money is deposited in RBC Guaranteed Investment Certificate (GIC) under the client’s name. This would then gain interest as long as the money there.

• Once the client has established a good credit rating after using the secured card well, the bank will release the GIC security from the clients account.

• 18 month is the minimum requirement to establish a credit rating.

CARRY A BALANCE – GOOD REWARDS AND BENEFITS

The cards under this category are those cards that contain credit that caters client who have fair or bad credit history. Credits that are given are enough for the card holder to use and not to get in trouble again with financial problems. This care will help these clients as they will provide reports to the credit bureaus monthly. Choose the card that is vital for you.

Orchard Bank Platinum Visa®

The Orchard Bank Platinum Visa is an ideal card for building or rebuilding credit. We present the card benefits that allow managing your account easy, such as a payment due date that you have chosen and online account access 24/7. The bank also provides text or email alerts to advise you ahead of time that a payment is due.

Rewards and Benefits of the credit card:

• Reports to 3 major credit bureaus monthly to update the client’s rebuilding of credit history.

• Customer service is ready to assist the card holder for questions or concerns.

• The card is accepted over millions of areas worldwide.

• Website purchases and reservation is available for service.

• The bank offers their client to create a personalized credit card.

• Card holders are given the opportunity to choose what day the bank will set with the due date.

• You can manage your account 24/7 through online service.

• Receive emails and text messages sent by the bank for reminders on due billings.

• Annual fee is at a reasonable cost of $39-$59.

DOESN’T CARRY A BALANCE – REWARDS CARD